A psilocibina de cogumelo mágico pode curar a depressão resistente a medicamentos

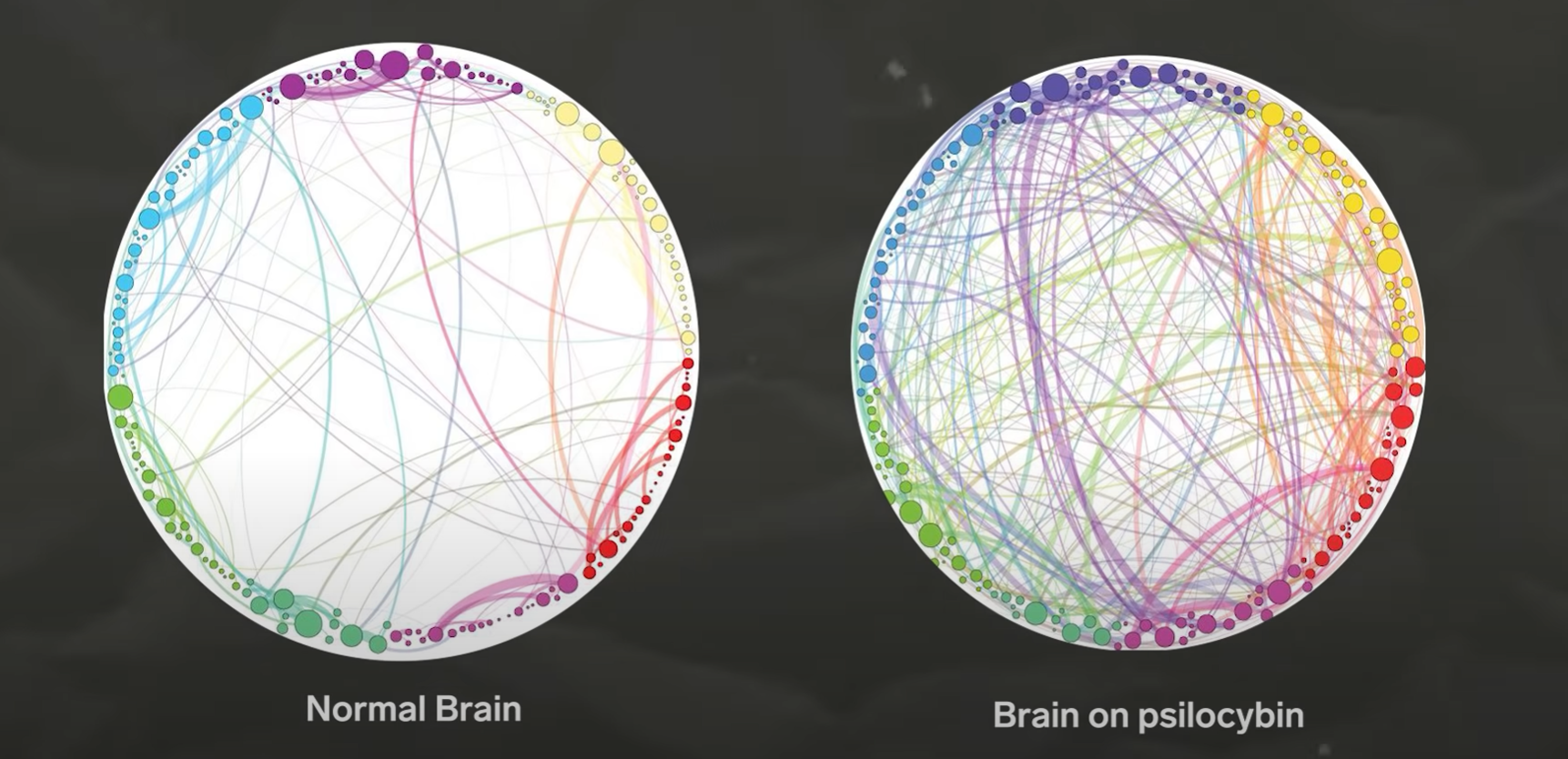

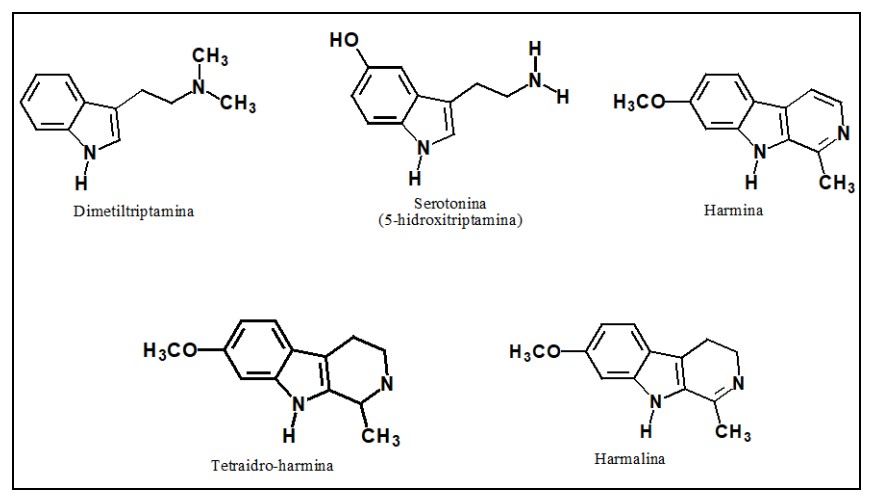

Durante anos, os cientistas têm observado cada vez mais seriamente o efeito terapêutico dos psicodélicos, substâncias frequentemente proibidas. No entanto, apesar desse interesse renovado, ainda faltam estudos em larga escala. …